Forex Swing Trading: A Comprehensive Guide

Forex swing trading is a popular trading strategy that allows traders to capitalize on short- to medium-term price movements in the foreign exchange market. The essence of swing trading lies in holding positions for several days to capture price "swings." This approach can be particularly beneficial for those who may not have the time to monitor the markets constantly, and it opens up numerous opportunities for traders who prefer a more patient and strategic approach to trading. If you're eager to dive deeper into forex swing trading, you might find valuable tools and resources at forex swing trading https://latam-webtrading.com/.

Understanding Swing Trading

Swing trading is distinct from day trading and scalping, which both involve shorter timeframes and more frequent trades. Instead, swing traders aim to "swing" into profitable trades by leveraging market volatility. The primary objective is to identify trend reversals or continuations and to enter trades that can yield significant returns over a less frenetic timeline.

Key Characteristics of Swing Trading

- Timeframe: Swing trades are usually held from a few days to a few weeks.

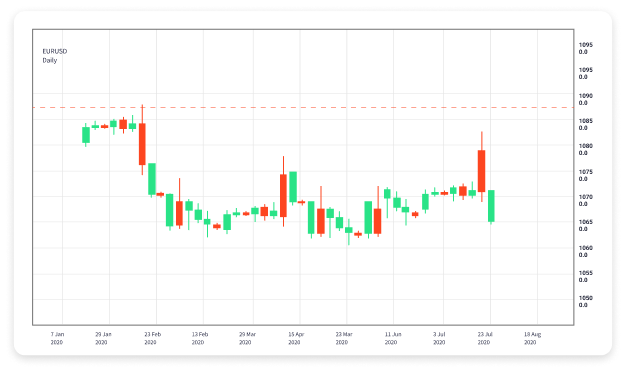

- Chart Analysis: Swing traders rely heavily on technical analysis, utilizing charts, indicators, and patterns.

- Risk Management: Successful swing trading emphasizes risk management, often employing stop-loss orders to minimize potential losses.

- Market Conditions: Swing traders thrive in volatile markets where price movements are more pronounced.

Why Choose Swing Trading?

There are several reasons why traders may prefer swing trading over other styles:

- Flexibility: Swing trading allows for a more flexible schedule, making it suitable for part-time traders or those with full-time jobs.

- Potential for High Returns: By targeting significant price moves, swing traders can achieve impressive returns on their investments.

- Reduced Stress: Unlike day trading, which requires continuous monitoring, swing trading can be more relaxed, allowing traders to analyze the market at their convenience.

- Engagement with Market Trends: Swing trading enables participants to engage with market trends without the need for real-time decision-making.

Essential Tools for Swing Trading

To excel in swing trading, you'll need a set of tools and resources:

- Trading Platform: A reliable trading platform with real-time data and analysis tools is pivotal.

- Technical Indicators: Tools such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can aid in decision-making.

- Economic Calendars: Stay informed about upcoming economic events that may impact currency prices.

- News Sources: Access to financial news can help you gauge market sentiment and make better trading decisions.

Developing a Swing Trading Strategy

Your success in swing trading largely depends on a well-defined strategy. Here are key steps to crafting an effective swing trading strategy:

1. Choose Your Markets

Focus on a select few currency pairs that you can monitor closely. Understanding the unique characteristics of each pair will give you a better insight into their price movements.

2. Use Technical Analysis

Utilize technical analysis to predict price movements. Look for patterns, support, resistance levels, and signals from indicators. Remember, price action is critical in swing trading.

3. Set Entry and Exit Points

Determine your entry and exit points based on your analysis. Consider setting stop-loss and take-profit orders to automate parts of your trading process and manage your risk effectively.

4. Manage Your Risk

Proper risk management is essential to safeguard your capital. Typically, traders risk 1-2% of their trading account on a single trade.

5. Review and Adjust

Regularly review your trading performance and make necessary adjustments to your strategy. Continuous learning and adaptation can help you refine your approach over time.

Common Mistakes in Swing Trading

Even with a solid strategy, beginners can easily fall into common traps. Here are some pitfalls to avoid:

- Overleveraging: Avoid using excessive leverage, as it can amplify losses.

- Emotional Trading: Stick to your plan and avoid making impulsive decisions based on emotions.

- Poor Risk Management: Failing to set stop-loss orders can lead to significant losses.

- Neglecting Market News: Ignoring news and events that impact currencies can be detrimental.

Conclusion

Forex swing trading presents a valuable opportunity for traders looking to maximize their earnings through strategic decision-making and patience. By developing a solid trading plan, utilizing effective tools, and avoiding common mistakes, you can enhance your chances of success in the forex market. As always, remember to keep learning and adapting to the ever-changing nature of the financial markets.